For the first time since the boom, the three product markets in Bend, (retail, office, and industrial) have single digit vacancy rates in the same quarter. Retail stands at 6.1%, office at 8.9%, and industrial is 6.6%. This is remarkable considering where we came from just a few years ago. It is also confirmation that the commercial real estate market is back!

Do you need 20,000 square feet of contiguous retail space? Good luck finding it. There are only two options from which to choose in Bend. Searching for 5,000 square feet of office space for your new high tech company? You had better move quickly. There are just seven properties that can accommodate your need. Have a requirement for 7,000 square feet of office/warehouse space to expand your widget production facility? There are just nine buildings in Bend with that amount of available square footage, and it is a certainty that at least half of these building owners won’t divide the building to meet your needs. You may need to expand your search to Redmond where there are currently five buildings that have enough vacancy to meet your requirement.

Under these conditions, one would expect to see developers stepping in to create more inventory. Why isn’t this happening? One reason is the lack of available/affordable land. During the last economic expansion, Bend experienced unprecedented commercial growth. Once plentiful, available land was snatched up and developed. Today, there are fewer options. In addition, many of the lots that remain available are because they are priced beyond what a potential development can support. This leads us to reason number two: rents don’t yet support new development. For example, the majority of office rents today range from $1.25 to $1.45 per square foot per month on a triple net basis and top out at about $1.65. Based upon land, material and labor prices, not to mention city fees, rents have to reach above $2.00 per square foot before it makes sense to develop more office product. Thus, speculative development will be slow in coming.

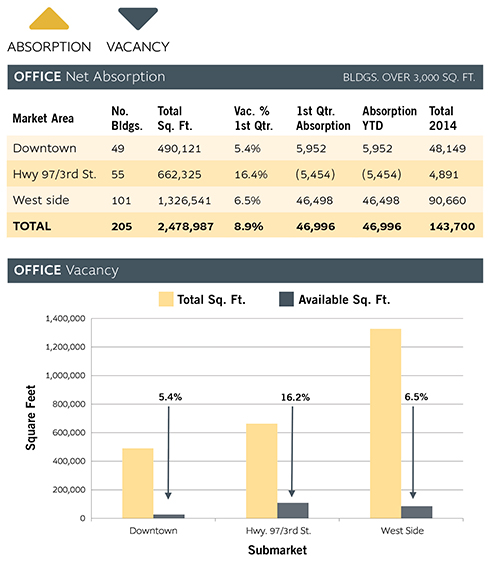

BEND OFFICE

Compass Commercial surveyed 205 buildings for the Q1 office report. The buildings in the sample totaled nearly 2.48 million square feet. 47,000 sq. ft. of positive absorption was recorded during the quarter. The citywide office vacancy rate decreased from 10.6% to 8.9% as a result. There is now 221,000 sq. ft. of available space for lease. This is the 11th consecutive quarter of positive absorption.

5,952 sq. ft. of positive net absorption was reported in the downtown submarket during the first quarter. 1000 Wall St. and The O’Kane Building accounted for most of the leasing. In Q1, Compass Commercial sold the mixed use Columbia Bank building at the corner of Wall St. and Newport/Greenwood Ave. The buyer plans to convert the second floor office space to apartment units. The office vacancy rate downtown now stands at 5.4% — down from 7% at the end of 2014.

The Hwy. 97/3rd Street corridor recorded 5,454 sq. ft. of negative net absorption in Q1. A number of new smaller vacancies outpaced several small signed leases resulting in the vacancy rate increasing by 1.2 percentage points to 16.4%.

The west side submarket recorded 46,500 sq. ft. of positive net absorption. The Mill A Building, 497 SW Century Dr., Vision Plaza, Building D at Shevlin Corporate Park, River West I, Osprey Point and Mt. Washington Center all reported notable leasing during Q1. The vacancy rate dropped to 6.5% from 9.5% as a result. In the last nine quarters, this submarket has had just one quarter of negative absorption.

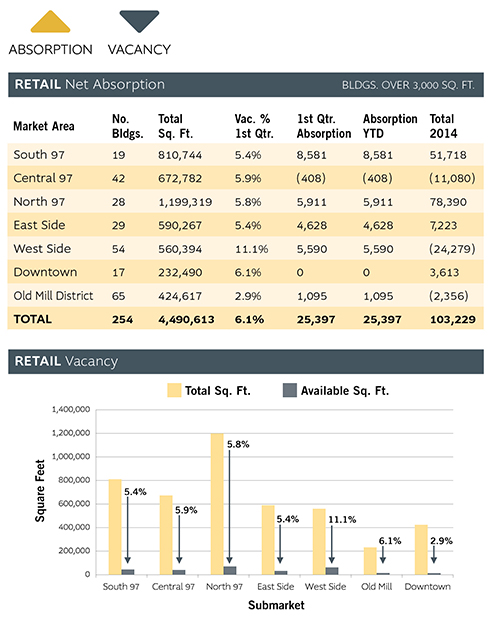

BEND RETAIL

Compass Commercial surveyed 254 retail buildings totaling nearly 4.5 million square feet for the first quarter 2015 retail report. The citywide vacancy dropped from 6.7% in Q4 to 6.1% at the end of Q1 due to 25,400 sq. ft. of positive net absorption. It was the fourth consecutive quarter of positive absorption for this product type.

It was an unusually quiet 90 days for retail in Bend. Of the seven submarkets, none reported absorption of 9,000 sq. ft. or more. The south 97 corridor led the way with 8,600 sq. ft. of positive net absorption. The greatest vacancy rate is that of the west side submarket. It currently stands at 11.1%, primarily due to the vacant former Ray’s Food Place in Westside Village. If we remove this vacancy from the statistics, the Westside vacancy rate becomes less than 4%. Downtown has the least amount of vacancy from a square footage and vacancy rate perspective (2.9%).

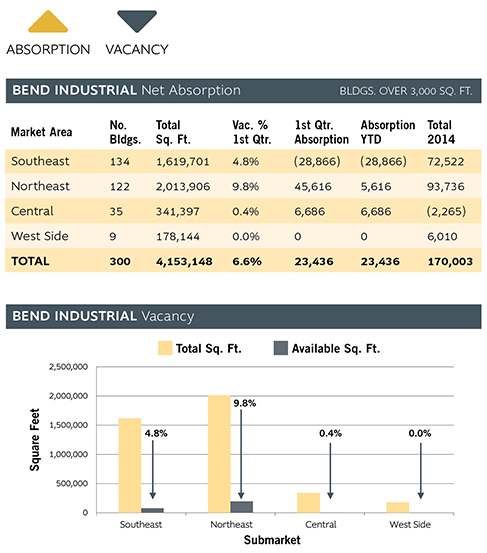

BEND INDUSTRIAL

Compass Commercial surveyed 300 buildings for the first quarter industrial report. The buildings in the sample totaled over 4.15 million square feet. There was 23,400 sq. ft. of positive net absorption over the first 90 days of the year. The citywide industrial vacancy rate decreased from 6.7% to 6.6%. There is roughly 275,000 sq. ft. of available space for lease.

The southeast submarket recorded 29,000 sq. ft. of negative net absorption in the first quarter. This means that move-outs exceeded move-ins. In the last 14 quarters, this is the second negative result recorded for this submarket. Despite this, few options remain available in this submarket. Just nine of the 134 buildings surveyed have any vacancy. The vacancy rate increased from 3.0% to 4.8% due to the new vacancies.

The northeast submarket recorded 46,000 sq. ft. of positive net absorption in Q1. The vacancy rate dropped from 11.4% to 9.8% as a result. Less than 8% of the buildings in this submarket reported having any vacancy. Most of these are larger spaces appealing to the less common large tenants.

The central submarket recorded 6,700 sq. ft. of positive net absorption. There is a single 1,250 square foot space available for lease in this submarket out of a total inventory of 342,000 sq. ft. The vacancy rate is now 0.4%.

The nine building, 178,000 sq. ft. west side submarket has no available space again this quarter. This is the second consecutive quarter in which the area offered no available space.

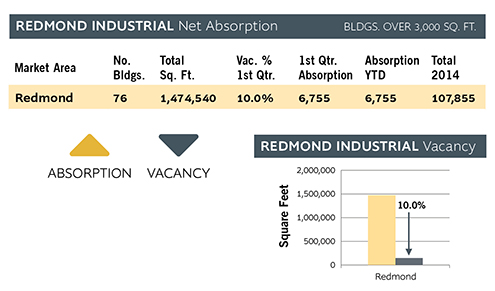

REDMOND INDUSTRIAL

The Compass Commercial survey included 76 buildings totaling over 1.47 million sq. ft. 6,800 sq. ft. of positive absorption was recorded with four buildings

reporting positive absorption over the past 90 days. Properties including Airport Industrial Park, 736 SW Umatilla, 2095 SE Badger and 1950 SE Badger, all reported healthy leasing activity in Q1. The leasing caused the vacancy rate to drop from 10.4% to 10%. There is now 147,000 sq. ft. of available space for lease.

![]()